Portugal tops Western Europe and ranks 7th globally in Greenfield FDI performance index

This year's edition of fDi Intelligence's Greenfield FDI Performance Index saw Portugal rise from third to first place for Western Europe and seventh in the world.

Costa Rica, North Macedonia and the UAE were the world’s best foreign direct investment (FDI) performers relative to the size of their economies in 2022.

In the eighth edition of fDi Intelligence’s Greenfield FDI Performance Index, Costa Rica retained its position as the country that attracts the most FDI relative to its gross domestic product (GDP), thus fortifying the attractiveness of its investment proposition in the wake of the Covid-19 pandemic and the war in Ukraine. North Macedonia and the UAE switched places from 2021, ranking second and third in 2022 respectively.

In the eighth edition of fDi Intelligence’s Greenfield FDI Performance Index, Costa Rica retained its position as the country that attracts the most FDI relative to its gross domestic product (GDP), thus fortifying the attractiveness of its investment proposition in the wake of the Covid-19 pandemic and the war in Ukraine. North Macedonia and the UAE switched places from 2021, ranking second and third in 2022 respectively.

Four other countries, Serbia, Lithuania, Malta and Singapore, retained their spots in the top 10.

The top 10 features four countries, North Macedonia, Georgia, Armenia and Malta, with a 2022 (GDP) under $25bn, illustrating the growing ability of emerging economies to target and attract FDI projects and compete with larger economies.

The UAE and Singapore remain the two major business hubs whose market share of FDI projects outweigh their GDP market share.

Of the 95 countries recording more than 10 FDI projects in 2022 and hence being considered for the 2022 index, 76 have an index score greater than 1.0, indicating a larger share of investment projects relative to their share of GDP. The remaining 19 have a score below 1.0, indicating a smaller share of projects relative to GDP.

For example, Costa Rica’s 2022 score stands at 12.7, which means that, given the size of its economy, it attracts 12.7 times more projects than the size of its GDP would suggest.

Georgia recorded the highest rise in project numbers relative to its 2022 GDP, with the country quadrupling its number of projects from eight to 32, having seen its GDP increase from $19bn in 2021 to $25bn in 2022. The UAE saw the second highest rise in project numbers relative to GDP, with the country’s project total rising from 541 in 2021 to 1000 in 2022.

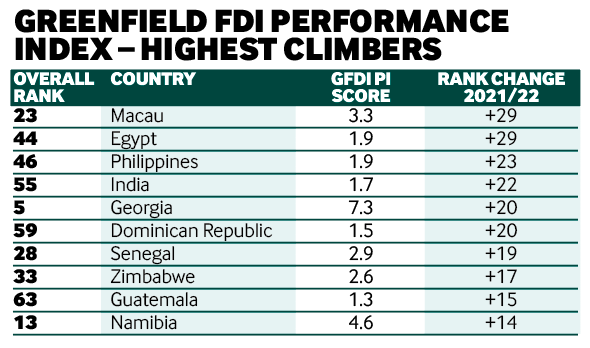

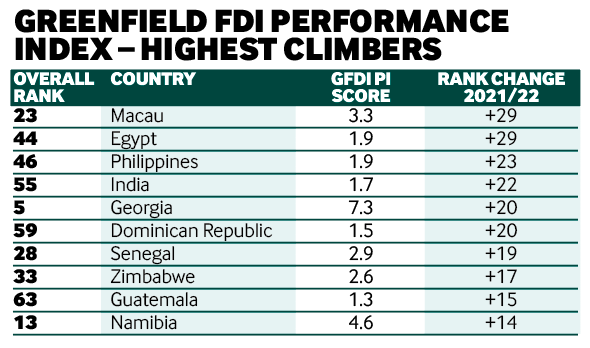

Highest climbers

This year Macau and Egypt recorded the joint highest rank change, climbing 29 places each to 52nd and 73rd position, respectively. In total, six countries climbed more than 20 places, with the Philippines rising 23 places, India 22, Georgia 20 and the Dominican Republic 20. African countries claimed nine places in the top 20 highest risers, with four of those in the top 10. Egypt doubled its index score from 0.96 in 2021 to 1.92 in 2022, meaning it doubled its project share relative to its GDP, with the renewables sector accounting for a sixth of its projects in 2022.

Russia lies at the bottom of the index as the lowest-scoring country. Its inbound FDI has all but halted while it wages war in Ukraine, registering an index score of 0.04. China (0.1) ranks second to bottom in 2022, recording 125 fewer projects than in 2021.

Asia-Pacific dominates the top 10 worst performers list with seven countries. The majority of these are the typically wealthier countries with high GDPs and a below market share of investment projects.

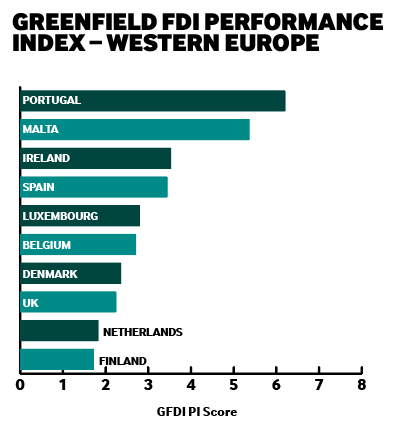

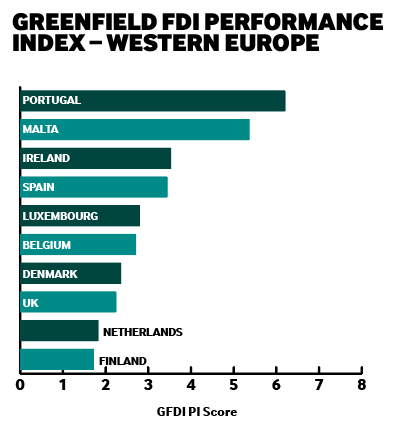

Western Europe

This year’s index for Western Europe saw Portugal (6.2) rise from third to first place, with Malta (5.4) and Ireland (3.5) falling one place each. The region received more than 6100 projects in 2022, more than any other region and accounting for 35% of the projects counted for this index.